utility for service tax return

Ad From Simple to Advanced Income Taxes. Utility 1044 MB Date of Utility release 13-Jul-2022.

Australia Tru Electricity Utility Bill Template Fully Editable In Psd Format Bill Template Statement Template Utility Bill

Urban transportation and watercraft vessels under 65 feet in length.

. However different rates apply to bus companies and railroads as shown below. Quickly Prepare and E-File Your 2021 Tax Return. Current Utility Tax Forms 2021 Utility Tax Forms.

Many families received advance payments of the Child Tax Credit in 2021. The tax is imposed on persons distributing supplying furnishing or selling electricity in Illinois for use and consumption not for resale. If you didnt receive advance payments you can claim the full amount of the 2021 Child Tax.

Download the applicable ITR fill the form offline save the generated XML file and then upload it. Make sure all preprinted information is correct for the tax period you are filing. The basic utility tax rate is 235 of gross income or gross operating income.

235 of gross income. Powerful Easy-to-use Tax Preparation Software. To e-File the ITR using the upload XML method the user must download either of.

Utility Expense Business Deduction. Download XML Schema for ST3 Return V16. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page.

A Form W-2 or 1099 is not tax return. Memorandum for Provisional Deposit of Service Tax. Tax due on the sale or transportation of natural or manufactured gas to retail consumers in Florida is computed.

Any other prior year tax return if you filed one. Please sign and date each return. NYC-UXP - Return of Excise Tax by Utilities for use by utilities other than railroads.

If you own a business the utility taxes you pay on its behalf are usually deductible. The person liable to pay Service Tax should himself assess the Tax due on the Services provided by him and shall furnish to the Superintendent of Central Excise on a half yearly basis in Form ST-3. You must file a monthly return even if no tax is owed.

Download ST3 Return Excel Utility V15 For Filing ST-3 returns for Half Year Oct-Mar 2015-2016 08-04-2016. Planning Zoning Approvals. Any supporting W-2s 1099s Schedule C Schedule F etc.

To register for Seattle utility taxes email taxseattlegov. Subsequent returns should be filed using INTIME. Documents on this page are provided in pdf format.

NYC-95UTX - Claim for REAP Credit Applied to the Utility Tax. Utility Receipts Tax Return. The amount of the tax shall be determined by the.

The Franchise is calculated in part as a. File Online with INTIME. Total gross sales to Indiana consumers by utility service providers collecting USUT Enter the amount of gross receipts received for furnishing utility services on.

Section 70 1 Finance Act 1994. Service Tax Appeal before Commissioner Appeals. E-File Directly to the IRS.

Please include your business name customer number or City account number type of utility you provide eg electric telephone and the desired reporting frequency annual quarterly or monthly. The Service Tax return is required to be filed by any person liable to pay the Service Tax. Business tax returns go under the other deductions line item on the face of the tax return.

Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23. The utility service use tax is an excise tax levied on the storage use or other consumption of electricity domestic water natural gas telegraph and telephone services in the State of AlabamaThe authority for collecting the utility service use tax is found in Sections 40-21-100 through 40-21-107 Code of Alabama 1975. Schedule a Virtual Planning Appointment.

Reconcile compare the total you received with the amount youre eligible to claim when you file your 2021 tax return. Railroads railroad car companies motor transportation and all. Information and tax tips for public utilities in the Delaware area.

The user can file the Income Tax Return ITR in two ways. First-time filers must use Form URT-1. Schedule or Cancel an Inspection.

Tax Deductor Collector. Find Your Propertys Zoning Category. Only utility expenses you incur for your business offices and buildings are deductible.

Energy Assistance Charges Renewable Energy Charges. Download XML Schema for ST3 Return V15. For Memorandum of Cross-Objections to the Appellate Tribunal.

The Form 1040-series tax return for the year shown on the letter Note. You can see your advance payments total in. The Franchise Tax is typically calculated on a percentage of the revenues derived from sales of the utility company to customers in the service area or territory.

File a Recorded Notice of Commencement. The franchise tax is applied to public service companies such as gas electric and telephone for the privilege of doing business in Maryland. Gross Receipts Tax on Utility Services is imposed at the rate of 25 on the sale delivery or transportation of natural gas manufactured gas excluding liquefied petroleum LP gas or electricity to a retail consumer in Florida.

Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. If youre a sole proprietor and you work. Service Tax Appeal before Appellate Tribunal us 862 or us 862A Form ST-7.

Underpayment of Estimated Utilities Receipts Tax. Each public utility must collect an Energy Assistance Charge and Renewable Energy Charge monthly from each of its customers. 117 of gross income.

NYC-98UTX - Claim for Lower Manhattan Relocation Employment Assistance Program LMREAP Credit Applied to the Utility Tax. Download ST3 Return Excel Utility V16 For filing ST-3 Returns for Half Year Apr-Sept 2016-2017 onwards 01-10-2016. Telegraph companies distribution of natural gas and collection of sewerage.

Return of Service Tax Excel Utility Form ST-3. 2022 Delaware Relief Rebate Program was signed on April 14 2022. Skip to Content Skip to Navigation.

Omnibus operators subject to NYS Department of Public Service supervision.

America S First Income Tax Form Mousepad Zazzle Com Income Tax Tax Forms Income

Gst Provisions Change Is The Only Costant After The Roll Out Of Gst On 1st July 2017 There Have Been More T Goods And Services Goods And Service Tax Change

Australia Macquire Bank Statement Easy To Fill Template In Excel Format Bank Statement Statement Template Templates

Apply Fake Tax Returns Statement Template How To Apply Bank Statement

Pin By Mark Jeffri On Bank Statement Editing Credit Card Statement Gas Bill Electricity Bill

60 Important Papers And Documents For A Home Filing System Checklist Home Filing System Estate Planning Checklist Organizing Paperwork

Download Gstr 4 Form Offline Utility V3 3 In Excel Format Sag Infotech Business Software Excel Offline

Tds Due Date List May 2020 Accounting Software Solutions Date List

Will Gst Digitize Smes To Cloud Computing Software Development Accounting Accounting Software

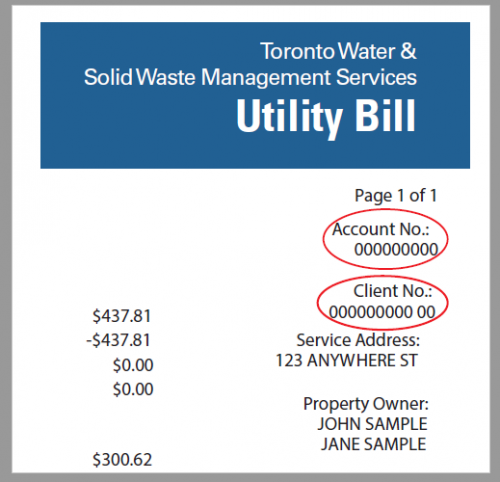

Tax And Utilities Answers City Of Toronto

Send Itr V In Tax Department Income Tax Return Income Tax Income Tax Preparation

Scanned Document Editing Service Tax Deductions Deduction Bank Statement

Pin On How To Create Purchase Order In Conifer Gst Certicom Consultants

I Have No Absolutely No Idea If My Taxes Are Accurate Former Secretary Of Defense Donal Http Dailym Ai P41den I A Tax Return Lettering Letter Templates

Easy Steps To Enroll Digital Signature Certificate On New Tax 2 0 Portal Government Portal Tax Software Digital

Streamline And Automate Your Work According To Your Need The Only Solution You Need To Manage All Your Tax Compliance Needs Sp Tax Software Solutions Income

Tax Return Personal Fake Tax Return Payroll Template Tax

Kdk Tds Software Arm Yourself With Tax Solutions That Meet Your Needs Today And Grow With You Tomorrow Suppo Tax Software Tax Deducted At Source Filing Taxes